Agencies and nonprofits promote child tax credit

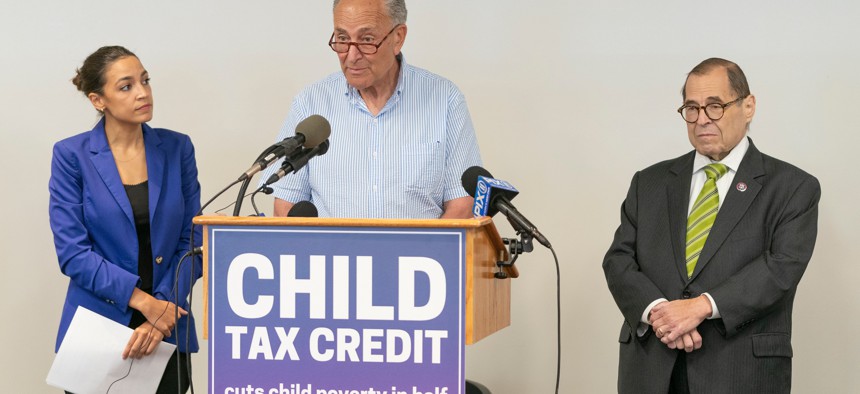

U. S. Senate Majority Leader Chuck Schumer promoting the Child Tax Credit alongside Rep. Alexandria Ocasio-Cortez and Rep. Jerry Nadler. lev radin / Shutterstock

Aiming to slash child poverty, the U.S. Treasury Department began sending the first installment of the Advance Child Tax Credit to families on July 15th by convenient direct-deposit payments to families. But, it’s not as easy for families who did not file tax returns or don’t have bank accounts. They need to take action to claim the Credit by either filing their taxes or entering their information with the IRS’s Child Tax Credit Non-Filer Sign-Up tool.

Multiple partnerships have formed among New York state and city agencies, and nonprofit organizations to help families claim the credit. The New York State Department of Child and Family Services said its outreach includes programs that work with families, parents, and youth who may be parents, as well as local social services districts. “We have widely promoted it on social media and on our website,” says John R. Craig, communications officer at OCFS, adding that they “are running a ‘hold message’ at our human services call center to provide this information statewide.”

Among city agencies involved in promoting the CTC, the New York City Housing Authority “is doing outreach through our Family Partnerships Department,” said Rochel Leah Goldblatt, deputy press secretary at NYCHA. “This outreach includes sharing information with our Community Engagement and Partnerships partners to share with developments and resident leaders.” In addition, NYCHA is promoting a webinar, including information in several newsletters to residents, and posting on social media. “We also plan to hand out flyers at NYCHA Family Days,” said Goldblatt. “We will be continuing this outreach through December, as residents who don’t receive the monthly payment would still be able to receive the credit when they file their taxes next year.”

NYC Kids Rise is one of many nonprofit organizations partnering as a resource to families who need to claim the Credit. “Through our network of partnerships, which includes both community-based organizations and the city’s Financial Empowerment Centers, we will be working to ensure information gets directly to families in as many ways as possible,” said Debra-Ellen Glickstein, executive director, citing the following strategies: through newsletters, town hall sessions, and individual outreach and conversations. “We want to be sure families can take advantage of this investment and opportunity in the ways that make most sense for them – whether that be to take care of immediate needs, save little by little for the future, or both.”

Community Service Society, a nonprofit that fights poverty on multiple fronts, does not conduct outreach, but it runs a training program for social services professionals that cover the impact of receiving child tax credits on those families who receive SNAP or public assistance, said Jeffrey N. Maclin, vice president for governmental and public relations. “The training is conducted as part of our Benefits Plus Learning Center. There is also a CTC section in Benefits Plus with the revised CTC under the American Rescue plan.”