New York City is about to bankrupt hundreds of nonprofits

596 Acres

In less than two weeks, the New York City Department of Finance will bankrupt and destroy 349 nonprofit institutions as of last week, converting their properties into capital for private banks through tax lien sales – but city leaders still have a chance to save them.

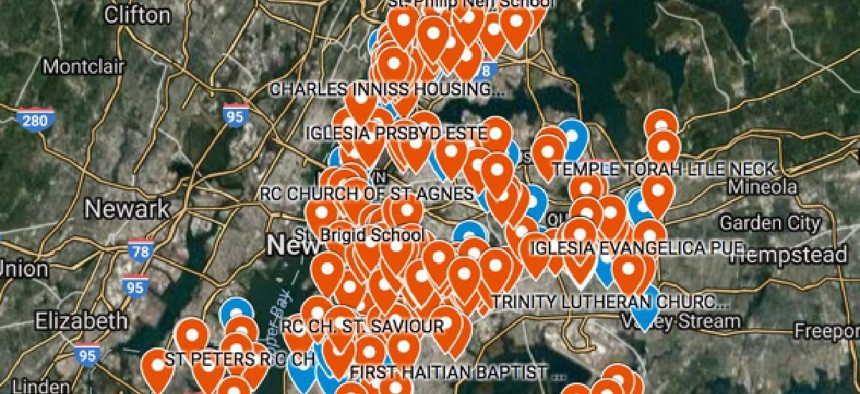

On May 12, the agency will wrongfully sell these properties and many others. The move will condemn their owners to crippling financial burdens and then to foreclosure by a private bank – even though state law exempts nonprofit organizations from property taxes in the first place. Also on the chopping block: 1,155 vacant lots, as of last week – spaces the city could develop into affordable housing, but will instead sell off for private development. The tax lien sale mechanism is complex, and its stakes are astronomical, but its solution is incredibly simple: the Department of Finance must immediately remove nonprofits and vacant lots from the tax lien sale.

The Department of Finance controls the tax lien sale and has the power to remove these properties, but has shown no inclination to do so. Without city leadership, many of these valuable community institutions will be uprooted, and their properties given over to the speculative capital market. This blunt policy instrument will pave the way for condos to replace hundreds of the churches, cemeteries, parsonages, food pantries, senior centers, charitable housing units, health centers, veteran centers, schools, community gardens and other vital building blocks of neighborhood strength and vitality.

Several of the “vacant” lots headed for a tax lien sale are in fact community gardens, long cultivated by engaged neighbors – like the Imani Community Garden, broken in half two years ago thanks to a previous 2004 tax lien sale. Most of these lots, however, are ownerless sites: precious resources that the city can claim outright and develop into affordable housing or other neighborhood amenities, as New York City Comptroller Scott Stringer urged in a report last year. These properties are the last unicorns of New York City real estate: free or nearly free parcels of land that the city can cheaply develop for permanent social benefits and maintain in perpetuity. The 2017 tax lien sale will kill every single one of them, rendering them nothing more than glue for the wealthy to cement their fortunes. That these lots lack owners also means that their tax debts are fictions; their inclusion in the tax lien sale is not only bad policy, but flatly unjustifiable.

How did we get here? Every year the tax lien sale wrongfully shackles hundreds of nonprofits with huge debts and then lets a private bank leverage additional fees and foreclose upon their properties. Nonprofit organizations are permanently tax-exempt under state law, but since 2012 the city Department of Finance has required them to go through a byzantine annual process to maintain this status on their properties. Many don't know that they need to do this, or don't have the capacity to follow through on it correctly. Debt and foreclosure by private banks often follows.

Just ask the ghost of the Grace Baptist Church. After the Department of Finance sold the tax lien on its property to private investors, who levied huge fees and interests on it, the church shuttered, selling the property to repay bills that should never have been sent. The congregation has scattered; their house of worship will be privately redeveloped. The Al-Muneer Foundation in Jamaica, Queens, fared better – by the skin of its teeth – eventually winning a protracted battle against foreclosure to private investors following a 2016 tax lien sale. Even in this case, however, the congregants wasted time, stress, money and other institutional resources on a demanding, uncertain and completely unnecessary battle that our tax codes were supposed to prevent. This is a quintessential failure of the government’s promise to its nonprofit institutions: that it will shelter them from property taxes so that they can reinvest that money into their missions and communities – not into navigating the city’s bureaucracy.

The good news: A solution is clear, easy and implementable. The Department of Finance can remove nonprofits and vacant lots from the 2017 tax lien sale. This year, responding to advocacy from 596 Acres, Fordham Law School and the Community Development Project of the Urban Justice Center, the agency has, for the first time ever, generated lists of the nonprofit-owned properties and vacant lots that it will include in the tax lien sale. It now needs to use the lists to exclude these properties.

The bad news: Instead, the Department of Finance expects each organization to contact them individually and navigate a labyrinthine negotiation. Many will fail to do this correctly or in time. The Community Development Project and 596 Acres have been leading the charge to guide each organization through the process.

It gets worse: The tax lien sale’s problems are actually much bigger than nonprofits and vacant lots. A growing body of research is exposing the tax lien sale as an exploitative piece of corporate-municipal machinery with racial biases.

A class-action lawsuit filed just last week by the NAACP and other plaintiffs demonstrates that the city systematically levies higher property taxes on nonwhite, nonwealthy property owners in poorer neighborhoods than it does on white, wealthy property owners in more affluent neighborhoods. This means that the vast majority of properties that fall into the tax lien sale – thousands of residential, commercial and industrial properties each year – are owned by black, brown and poor New Yorkers living in neighborhoods with the worst access to jobs, capital or support. In other words, the tax lien sale affects those with the most to lose and the least ability to recover after the sale inflates their debts. The system shackles residents into cycles of debt servitude in communities with the greatest need for social resiliency. We have a serious duty to combat it.

While halting the tax lien sale is unlikely in 2017, the nonprofit properties and vacant lots up for sale can still be saved. The mayor and other city officials can direct the Department of Finance to remove nonprofits and vacant lots from the 2017 sale right now; some New York City Council members are already advocating for this change.

We need city leadership to demand these changes or 2017 will go down as a banner year for the sale of vital public resources to the speculative capital market – and the year when New York City sold off its last chance to permanently develop affordable housing on free, city-owned land. As the tax lien sale threatens to destroy so many cornerstones of neighborhood resiliency, the city has a critical opportunity to intervene and protect the institutions that give our communities continuity, fortitude and hope.

Josh Bisker is an urban planner, bicycle activist and performance artist. Bisker serves on the advisory boards of two local institutions, the Bindlestiff Family Cirkus and 596 Acres; he is also a co-founder of the Mechanical Gardens Bike Co-op.