Opinion

Opinion: Thousands of NYCHA tenants forgotten under Emergency Rental Assistance Program

Residents in public housing deserve the same relief that millions of renters received across the state, but instead face mass evictions.

New York City Housing Authority buildings in Brooklyn. Spencer Platt /Staff Getty

The New York State Emergency Rental Assistance Program, which helped residents who missed rent payments during the COVID-19 Pandemic, ignored New York City Housing Authority tenants since its inception. Now, almost three years after the pandemic began, thousands of New York City’s public housing residents are facing large rental arrears, totaling $454 million across 73,028 households, most of which were accrued over the pandemic. All NYCHA residents want is the same relief that millions of other renters received across the state.

On Friday, the State will stop accepting ERAP applications due to the lack of new funding. Even with the 179,000 unpaid applications that have been submitted and the $85 million-worth of new applications that flood in every month, the U.S. Department of Treasury has not met the need for New York.

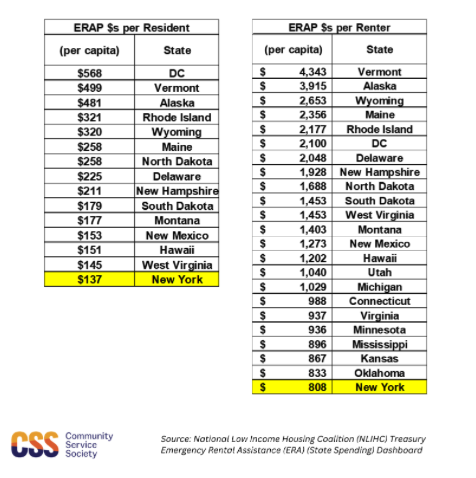

Despite the city having the highest proportion of renters in the United States, the highest cost of living, and the biggest increase in rents since the pandemic, 14 states received higher ERAP allocations per capita; New York was 25th in rental assistance dollars per renter. Based on past allocations, the New York’s Office of Temporary and Disability Assistance (OTDA) (the program’s administrator) expects the U.S. Treasury to send New York $77 million at most in its final two allocations; that would only be enough to cover 7 1/2% of what the office requested. This shortfall landed at the feet of NYCHA residents.

How? First, state lawmakers put NYCHA tenants in the back of the ERAP line, assuming that NYCHA tenants wouldn’t need help because their rents adjust as incomes change. But lawmakers forgot that NYCHA needs rent payments to manage housing. Worse yet, the state bungled the rollout of the program, with New York being one of the last states to spend any funds, and its $15 million portal didn’t even work initially. By the time New York began distributing its first payments, Texas for example, had already distributed nearly half a million in rental assistance. Down the coast, Maryland’s rental assistance program prioritized public housing and other low-income tenants, unlike New York. Other programs prioritized populations based on family makeup, age, and neighborhood, considered housing and social equity factors, pandemic impact, measures of health equity, and one even prioritized food stamp program recipients – all novel approaches to center, not exclude, those most in need.

To their credit, Mayor Eric Adams and Gov. Kathy Hochul have called for more federal emergency rental assistance funding and the governor has aptly pointed out that it was the Legislature that deprioritized the applications of NYCHA tenants for the program. But, when it comes to rectifying the situation facing NYCHA tenants, both have largely been silent. Hochul’s recent State of the State mentioned NYCHA once, celebrating the passage of the Preservation Trust Legislation that will rehabilitate 25,000 households. She said nothing of the thousands of households that will still be in the Section 9 program and proposed no additional ERAP funding despite touting “unprecedented revenues” and money set aside for a “rainy day”. Well, it’s raining, and NYCHA executives have not taken mass evictions off the table to preclude a fiscal disaster.

NYCHA points to factors outside of their control for this fiscal crisis. The agency didn’t have a month’s-worth of reserves at year’s end (the Department of Housing and Urban Development recommends three months of reserves for a large public housing authority). And the agency has not taken evictions off the table. NYCHA CEO Lisa Bova-Hiatt told a room full of journalists before the new year that “it’s really not in our prerogative to try and evict everyone, but we really do need the revenue.” Tenants are being painted as the enemy – responsible for a “culture shift” of non-payment as NYCHA CFO Annika Lescott-Martinez put it. However, rent collection was not an issue until a global pandemic turned everyone’s lives upside-down.

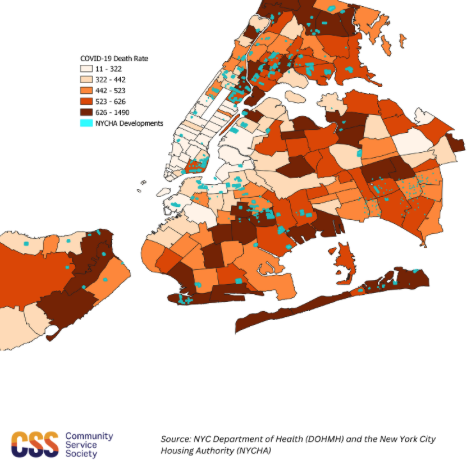

When any tenant is facing a huge rent bill, paying it down in increments (when everyone else received relief) seems absurd. Unlike NYCHA tenants, New York City’s market rate tenants received ERAP funds. But inflation, job loss, and the impacts of COVID-19 hit everyone, including NYCHA residents. While we still don’t know the magnitude of the impact the pandemic had on workers and tenants in NYCHA, we do know that many-NYCHA developments were in COVID hotspots.

Furthermore, at some point renters not being “rent-burdened” or paying less than 30% of one’s income on rent (as NYCHA tenants do) became this magical target for the housing policy establishment and politicians. However, 30% for middle- or high-income residents isn’t the same as 30% for low-income residents. While rent collection remained near 100% prior to the pandemic, a portion of NYCHA households did have some arrears despite rent adjustments, displaying that even non-rent burdened households can face financial hurdles in the most expensive city in the world.

NYCHA should not move to demonize residents and prepare for mass evictions because of COVID-19-related arrears. While the Safe Harbor Act – a bill that stops landlords from evicting for pandemic-related income loss – will protect some NYCHA tenants with arrears, many have owed rent that won’t be covered by the law because some of the missing rent wasn’t due during the state of emergency. These cases will have to go through a backed-up housing court system that is currently short on the legal representation that New York City’s `Right to Counsel’ law promised. NYCHA has begun evicting the 2,600 households with substantial arrears from before the pandemic. It’s time to take action to protect as many NYCHA residents as we can from eviction.

To start, the U.S. Treasury must reallocate unused rental assistance funds in a fair way that accounts for the need in New York. The allocation must at least cover the $250 million worth in applications already submitted. Concurrently, the state must change the ERAP law to allow funding to flow to NYCHA residents. With Treasury Rental Assistance dollars drying up, the city and state must come together to cover any pandemic-related NYCHA arrears left unpaid. State lawmakers created and funded two special programs worth $318 million to support those in need during the pandemic, one to cover rental arrears for private landlords, even if they already evicted the tenant, and another to assist high-income tenants. They can do the same for NYCHA residents in the FY2023-24 adopted budget. And the city must chip in with one-shot deals (or some form of rental assistance) and real employment and social supports as many try to recover from the pandemic and deal with inflation. Without these interventions, our political leaders are exposing the last vestige of truly affordable, social housing in America to homelessness and instability.

Iziah Thompson is senior policy analyst at the Community Service Society of New York and Marquis Jenkins is resident of NYCHA’s Bracetti Plaza and founding member of Residents to Preserve Public Housing, a public housing community organizer.

NEXT STORY: Real Talk: A New Year’s check in on New York City contract delays